Debt Management Plan Singapore: Secure Your Monetary Future with Ease

Debt Management Plan Singapore: Secure Your Monetary Future with Ease

Blog Article

The Comprehensive Guide to Creating an Efficient Debt Administration Plan for Conquering Financial Obstacles

Navigating monetary challenges requires a critical approach to debt monitoring, underscored by a thorough understanding of one's financial landscape. By carefully examining earnings, costs, and impressive financial obligations, people can establish a clear foundation for their economic goals. In addition, the implementation of efficient budgeting methods and financial obligation payment methods can substantially improve one's capability to reclaim control over their economic circumstances. As we check out these crucial components, it comes to be apparent that the path to economic security is not only attainable but also requires a dedication to recurring technique and educated decision-making. What particular methods might best suit your one-of-a-kind situation?

Comprehending Your Financial Situation

Numerous individuals discover themselves unpredictable regarding their financial standing, which can complicate the financial debt administration procedure. A clear understanding of one's monetary situation is important for efficient financial obligation management. This includes carrying out a thorough analysis of income, expenditures, possessions, and responsibilities. A comprehensive evaluation helps in recognizing truth financial picture and highlights locations that require prompt focus.

To begin, individuals ought to detail all income sources, consisting of incomes, sideline, and easy revenue streams. Next, an in-depth account of regular monthly costs ought to be recorded, categorizing them right into fixed and variable expenses. This permits an exact estimation of non reusable income, which is essential in identifying exactly how much can be alloted toward financial obligation settlement.

Additionally, individuals should compile a list of all debts, keeping in mind the amounts owed, rates of interest, and repayment terms. This will certainly give insight into which financial obligations are much more pressing and may require prioritization. Understanding one's financial situation not just help in effective financial debt management but also lays a solid foundation for future monetary planning. This action is critical in guaranteeing that people can browse their economic challenges a lot more effectively and function in the direction of achieving long-lasting stability.

Setting Clear Financial Goals

Developing clear economic objectives is a vital following step after acquiring a thorough understanding of your financial circumstance. These goals offer as a roadmap, directing your initiatives and decisions as you work in the direction of achieving financial stability.

Utilize the clever requirements-- Certain, Quantifiable, Achievable, Appropriate, and Time-bound-- to ensure your goals are well-defined. For example, rather than stating, "I wish to conserve more money," specify, "I will save $5,000 for a reserve within the following year." This clearness not just boosts focus yet additionally enables for far better tracking of your progression.

In addition, prioritize your objectives according to their necessity and importance. This prioritization helps in routing your resources successfully, ensuring that crucial goals are dealt with first. By setting clear economic objectives, you develop an organized method to managing your financial obligations and navigating economic obstacles, eventually positioning on your own for a more secure financial future.

Developing a Budget Plan

Developing a budget strategy is important for handling your financial resources properly and ensuring that you remain on track towards attaining your economic goals. A well-structured spending plan functions as a roadmap, leading your spending and saving choices while aiding you identify locations for renovation.

To establish an effective budget strategy, begin by detailing all income sources, consisting of income, perks, and any side incomes. Next, categorize your expenses into fixed and variable expenses. Set costs, such as lease or mortgage payments, stay continuous, while variable costs, like grocery stores and home entertainment, can vary.

When you have a clear photo of your earnings and expenses, allocate funds to every group based upon your financial priorities. Ensure that your spending plan enables financial savings and financial debt settlement, and take into consideration utilizing the 50/30/20 policy-- 50% for requirements, 30% for wants, and 20% for savings and debt.

Review your budget plan regular monthly to adjust for any kind of modifications in revenue or costs, and track your investing to ensure adherence (debt management plan singapore). By dedicating to a self-displined budgeting process, you can gain control over your financial resources and pursue monetary security

Exploring Financial Obligation Repayment Strategies

Debt settlement techniques are crucial for redeeming economic security and decreasing the worry of superior responsibilities. Numerous methods can be used, each developed to properly deal with the unique situations of individuals dealing with debt difficulties.

One popular approach is the debt snowball method, which prioritizes paying off the tiniest financial debts initially. This technique supplies mental motivation as individuals experience quick success, cultivating a feeling of success. On the other hand, the financial debt avalanche read the article strategy focuses on repaying financial obligations with the highest rate of interest initially, ultimately minimizing the complete passion paid with time.

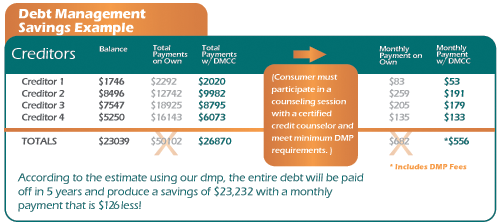

An additional effective technique is financial obligation combination, which entails integrating multiple financial obligations right into a solitary loan with a lower rate of interest. This not only streamlines the repayment procedure yet can also lower month-to-month repayments. In addition, discussing with lenders for extra beneficial terms, such as reduced rates of interest or extensive settlement durations, can reduce economic strain.

Maintaining Financial Discipline

Successful debt repayment techniques hinge article source not just on the methods selected however also on the technique worked out throughout the procedure. Preserving monetary self-control is vital for making sure that people abide by their debt monitoring plans and achieve their monetary objectives. This includes producing a structured spending plan that prioritizes financial obligation repayment while enabling required living costs.

One effective approach to growing technique is to establish clear, possible goals. People must break down their overall financial debt into smaller sized, convenient targets, which can help foster a feeling of achievement as each goal is satisfied. Additionally, regularly evaluating one's financial scenario and adjusting the spending plan as required can reinforce dedication to the plan.

Ultimately, keeping economic self-control calls for consistent effort and mindfulness (debt management plan singapore). By focusing on financial debt settlement and embracing sensible costs practices, people can browse their economic challenges successfully and lead the means for an extra protected financial future

Final Thought

Finally, establishing why not check here an effective debt monitoring plan requires a thorough understanding of one's financial scenario, paired with the solution of clear, achievable objectives. An organized budget plan, lined up with strategic financial obligation payment approaches, is important for navigating economic challenges. Additionally, preserving economic discipline through regular analyses and the establishment of an emergency situation fund ensures long-lasting stability. By adhering to these concepts, people can significantly enhance their ability to manage financial debt and attain economic health.

Navigating financial difficulties requires a critical strategy to financial debt administration, underscored by an extensive understanding of one's financial landscape. Recognizing one's monetary circumstance not just aids in reliable financial debt management however likewise lays a strong foundation for future economic planning.Developing clear monetary goals is a crucial next step after acquiring an extensive understanding of your financial situation. By setting clear financial goals, you create an organized approach to managing your financial debts and navigating financial obstacles, eventually positioning yourself for an extra safe and secure monetary future.

Report this page